Increasing ambitions in Bonn

Increasing mitigation and financing ambitions through action on international transport was the topic of our side event at the Bonn Climate Change Conference, June 2013. See the Presentation

Increasing mitigation and financing ambitions through action on international transport was the topic of our side event at the Bonn Climate Change Conference, June 2013. See the Presentation ![]() (1 MB) and the new RM Aviation Fact Sheet

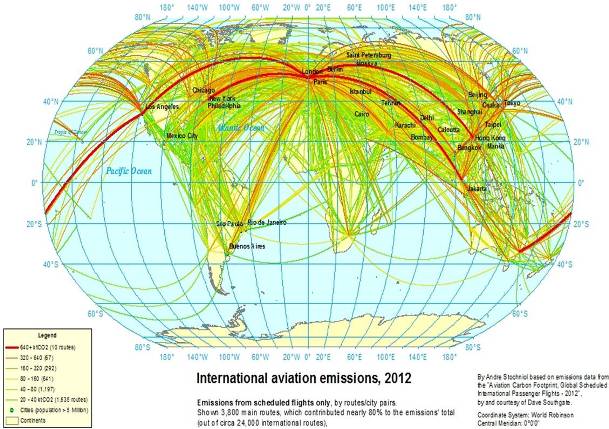

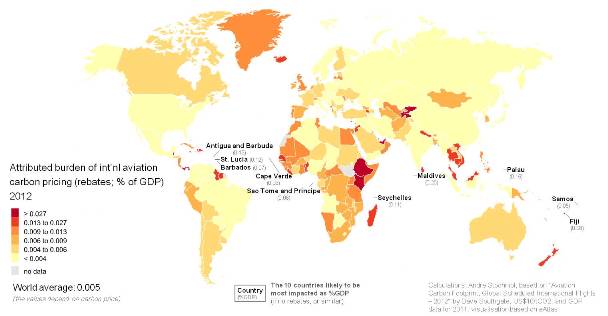

(1 MB) and the new RM Aviation Fact Sheet ![]() (1.3 MB). The presentation was focused on international aviation and included new maps for: (1) international aviation carbon footprint (concentrated in North, as shown), and (2) potential burden of aviation carbon pricing (which, as % of GDP, would be the largest in South). Application of the Rebate Mechanism (RM) to address the disproportional burden on some of the poorest countries was presented and debated.

(1.3 MB). The presentation was focused on international aviation and included new maps for: (1) international aviation carbon footprint (concentrated in North, as shown), and (2) potential burden of aviation carbon pricing (which, as % of GDP, would be the largest in South). Application of the Rebate Mechanism (RM) to address the disproportional burden on some of the poorest countries was presented and debated.

The side event, held on 7 June, was dedicated to carbon pricing of international transport as a mechanism to increase mitigation and financing ambitions for climate change action, while delivering on equity. It was focused on the need for and ways to ensure fair and effective carbon pricing of international aviation and shipping (see the Event flyer ![]() , 0.5 MB)

, 0.5 MB)

The need for fair and efficient carbon pricing of international transport

At the event we have argued again to address equity in order to enable global action, and increased ambitions, for international transport to reduce emissions and contribute to climate change adaptation, in particular by the relatively better-off passengers flying internationally.

To add to the previous results for shipping, we have also presented new calculations for international aviation emissions using two distinctive views:

View 1: CO2 footprint of international aviation

As expected carbon footprint of international aviation is largest on routes to/from certain high-income countries, primarily in North. This includes the United Kingdom, as 8 out of 10 routes with the greatest carbon footprint originate or end at London Heathrow airport (as shown).

View 2: Burden of carbon pricing, as % of GDP

Perhaps surprisingly to some, the largest burden of carbon pricing of international aviation (as % of GDP) may fall on some of the poorest countries (in South) as shown above. This would be the case, unless the regressive character of carbon pricing is somehow dealt with, for instance through a rebate mechanism/rebates, or similar. The 10 most impacted countries shown are all Small Island Developing States (SIDS), with some also being Least Developed Countries (LDCs). If not addressed, the burden on these countries from carbon pricing of international aviation may be 10 times+ greater than the world average.

Rebate Mechanism (RM) proposal for international transport

Shortest definition (c. 140 characters)

All ships/planes pay for their emissions. Certain countries obtain rebates, and the remaining revenue goes to climate change action, including in the sector.

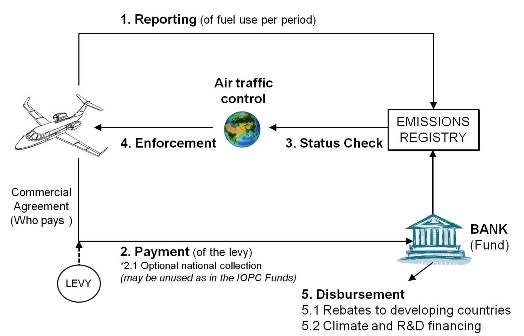

RM could apply to any revenue raising market-based measure (MBM), such as a levy/charge or ETS.

How could RM work in aviation?

The RM could be integrated with a levy proposal as shown below, in which the central Emissions Registry would ensure low cost and easy enforcement through Air traffic control.

For the IMERS proposal for shipping (aka RM integrated) see slide #10 in the presentation, and various backup slides, or check the IMERS (RM integrated), or the Fact. For the RM add-on details, including draft legal text, check the Rebate Mechanism (RM add-on).

We tentatively call the above integration an IA Fund, for an International Aviation Fund for Sustainable Development, for which the shortest description is as follows.

IA Fund proposal for aviation (in 140 characters)

A global levy on fuel for international aviation, with the RM, that may contribute $5bn to climate change action, including in the sector.

For a longer description and further details, see RM Aviation Fact Sheet ![]() (1.1 MB).

(1.1 MB).

Further side event details

Speaker and Panellist

- Andre Stochniol, IMERS

- Erik Haites, Margaree Consultants

Presentation and appreciations

Two versions of the presentation, the aviation and shipping fact sheets, and the event flyer are available:- Presentation only

(1 MB).

(1 MB). - Presentation with back-up slides

(2 MB) (some of the additional slides were used during the debate)

(2 MB) (some of the additional slides were used during the debate)

- RM Aviation Fact Sheet

(1.3 MB)

(1.3 MB)

- RM Shipping Fact Sheet

(1.1 MB)

(1.1 MB)

- Event flyer

(0.5 MB).

(0.5 MB).

Other side events in Bonn

The following related side events took place during the UNFCCC meeting in Bonn:- An Equitable Solution to Curb Aviation Emissions, organized by the Bread for the World (BfdW)

- Market Based Measures for International Transport, organized by the WWF